Raise the Bar to What you Deserve

Professional athletes and entertainers often expect too little

When it comes to athletes and entertainers defining their financial success, the threshold has been set too low. We’ve all heard the horror stories – incredible success followed quickly by financial ruin. In fact, a study cited by Sports Illustrated in 2009 (1) found that approximately 78% of all NFL players are bankrupt or in financial distress within two years of ending their playing careers. The same study reported that about 60% of NBA players are bankrupt within five years after the conclusion of their playing careers. A similar Fortune magazine article states that a working paper from the National Bureau of Economic Research found that the percentage of NFL players who go bankrupt after 12 years climbs to 15.7%! (2) The 2012 ESPN: 30 for 30 episode, “Broke,” (3) further discussed the horror stories and pitfalls of numerous athletes on their way to financial failure. Even though people are familiar with these issues, there is not much that has changed. Statistics today continue to mirror the findings from 2009, and we still read stories of those who mismanage or eventually lose their significant wealth.

Professional sports leagues and their unions have attempted to go on the offensive and many now require certifications for financial professionals interested in being recommended to athletes. As an example, the registration process through the National Football League Players Association (NFLPA) includes completing paperwork, paying a fee and attending a yearly seminar. The NFLPA prohibits its separately certified contract advisors from recommending any financial professional that has not been registered through the NFLPA program. However, this program does not oversee financial professionals that connect directly with NFL players through their own direct solicitation.

Regarding the entertainment industry, there are virtually no available statistics for similar rates of financial failure. Instead, history shows recurring victimization carried through mismanaged financial accounts by business managers and lawyers, absconded fraudulent funds, failed investment opportunities and nefarious schemes like those of Bernie Madoff, which deceived far too many Hollywood elites.

Overall advocacy for professional athletes’ and entertainers’ financial well-being is inadequate, in part because the financial services industry can sometimes be more focused on short-term gains than on what is in the best long-term interests of the clients they serve. Now, combine that with the simple fact that the bar is set too low by the clients themselves. The people who wow us in the arenas and the movie theaters position their baseline as simply not losing money. One can compare athletes and entertainers, who own their own personal brands, to entrepreneurs and business owners, who own their own firms. The biggest difference, however, is in their expectations. Entrepreneurs and successful business owners would never accept “break-even” as an indication that they are receiving acceptable or competent financial advice. Successful investors drive themselves to be educated and their advisors to be a part of that process. They want to know what they are doing and why, and, most importantly, they want to see the same type of results that they are creating in their business lives.

Entire careers and even lives are spent in the pursuit of financial freedom and creating a legacy that can be passed down for generations. Building wealth is a process that starts simply with budgeting and planning, and eventually matures through detailed due diligence and calculated, educated risk-taking. The benefit of any investment opportunity should go to the individual investor and not be eroded by excessive fees, commissions and hidden markups that get paid to advisors and other middlemen as kickbacks. This is how successful individuals build wealth: they have a strategy unique to their needs, build a plan around that strategy that they understand and execute the plan over an intended period in a way that maximizes their return without erosion. The key component of building wealth strategically is in the quality of advice they receive from their advisors that allows them to seamlessly follow this described path.

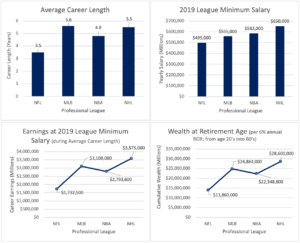

The sports and entertainment communities need to find a way to articulate and demand more from their financial advisors. In order to illustrate how pressing this need is, we can look at the collectively bargained minimum salary per each major professional league for the 2019 year. By carrying that 2019 minimum salary amount over the duration of the current average career length for each league, we will approximate an extremely conservative career earnings figure for an athlete in each major sport. Using the Rule of 72, with a 6% annual return we can expect this career earnings figure to double approximately every 12 years (4). Since most average professional athletes will retire from playing in their 20’s, at a 6% return, they should reasonably be able to see their earnings figure double 3 times before they hit their mid-60’s and typical retirement age.

These career earning amounts exclude taxes, cost of living, and other reductions because, for this example, the significantly higher average salaries (5) that exist in professional sports over the utilized 2019 league minimums are also being ignored. While these numbers would be eroded by real-world factors, they would also increase exponentially if higher paid salary averages or amounts, and career lengths stretching beyond averages were considered in any fashion. This would also be true if increasing annual rate of return over the utilized 6% from career end around age 20 into an age 60 retirement range.

Over the course of an average 3.5-year NFL career, the NFL minimum 2019 salary of $495,000 would total approximately $1,732,500. By a typical retirement age in their 60’s, this player would see their money double 3 times to approximately $13,860,000 using the described Rule of 72 at 6% over that span. The same type of MLB player using the same considerations and a 2019 MLB minimum salary of $555,000 would earn about $3,108,000 over an average 5.6-year MLB career. This would double 3 times into the 60’s age bracket and be worth approximately $24,864,000 around retirement. An NBA player making a 2019 NBA minimum salary of $582,000 over a 4.8-year average career length would total $2,793,600 and similarly $22,348,800 into their 60’s retirement. The NHL player making the 2019 league minimum of $650,000 over a 5.5-year-long average career would comparably make $3,757,000 during this time and would see an approximate increase to $28,600,000 by retirement in their 60’s using the same calculations.

Entertainment numbers are virtually impossible to estimate because of the sheer volume of participants in the industry and the variety of participation rates. Per the U.S. Bureau of Labor and Statistics (6), the median hourly salary for entertainers in 2018 was $17.54 but correlating this to an average number of hours worked or an average age range for earnings per entertainer would be speculative at best. Few entertainers ever get to the point where performing is much beyond a second or third profession for any point in their career and reaching “Hollywood elite” status, as it compares to the total number of participants trying, is like finding the horn of a unicorn on the surface of Haley’s Comet as it passes Earth. The sports league examples here are using real data estimated in an extremely conservative way and systematically eliminating the ultra-high net worth individuals that exist in those arenas. Entertainers can clearly relate to these examples because they universally emphasize the importance of wealth preservation and growth for everyone. One advantage that entertainers possess over their sports-related counterparts is that entertainers can work in their craft over a much longer timeline than athletes. We appreciate that many athletes and entertainers fall outside the median yearly salary and the average career length, but the power of compounding excellent advice over time is undeniable. This was another reason to utilize conservative examples in the illustrations. The ability to seek out and receive the type of advice that the individuals in these specialized industries deserve is independent of where they fall on any spectrum.

Creating access to sophisticated advice built upon client-first fundamentals involves changing the clients’ perspective to know what it is they need and deserve. Clients with the opportunity to earn multiple life savings in a matter of years before their 30th birthday need to accelerate their financial education to help them understand that they need to approach their financial situations the same way multi-million-dollar business owners structure theirs. Unlike business owners who may build their companies for 30 years before a significant liquidity event, creating the time to learn and plan for a windfall, the window of time for athletes and entertainers is often condensed because of the nature of their prime earning years. Some athletes and entertainers may go years or their entire post-career lives without earning another significant dollar beyond what their initial savings and invested assets provide them. Aggressive education is vitally important, but so is the overall function of the investment machine and the focus on fees, commissions and the erosion of compounding interest.

These are not the topics the financial industry typically likes to address head-on, and they are difficult to understand even for the most advanced investors. Under the guise of forced savings, annuities and insurance products, that hide large commissions and kickback fees paid to financial planners, are used to create the perception that an advisor is helping their client plan long term, while they are creating a significant revenue stream for themselves with client money. An industry built around clients should focus on the clients and make sure they are first, last and always. The financial education level, age of the client or source of capital should all be irrelevant when determining the best way to educate, guide and help a client succeed. Public figures who are well-educated, high-earning and excellent in their craft are often not holding their financial advisors to the same high standards of excellence they deserve. They are often young, extraordinarily busy and do not have experience in managing financial affairs. They then falsely assume that an advisor always acts in their best interests.

Clients entrust their financial advisors to understand their needs and represent them well in every aspect of life. If a financial advisor cannot explain how they are compensated in easy-to-understand terms, then the athlete or entertainer must question that relationship. By asking simple questions, they can understand how much money their financial advisor makes from each dollar they invest for them. With the assurance that their advisor is acting only on their behalf and in their best interests, they will ease their worries and grow wealthy from the money they have worked diligently to earn. Being confident in how their finances are managed can mean the difference between early full retirement or being bankrupt, so when athletes and entertainers hand off their financial future to a professional, they need to make sure that they can trust their advisor and demand a clear plan and a long future of building wealth.

1 Pablo S. Torre (March 23, 2009). “How (and Why) Athletes Go Broke”. Sports Illustrated. Archived from the original on 2009-08-11. Retrieved January 6, 2011.

2 Roberts, Daniel (April 15, 2015). “16% of retired NFL players go bankrupt, a report says”. Fortune.

3 ESPN 30 for 30, Episode “Broke” October 2, 2012

4 Rule of 72 calculation (72/6=12), states that an amount earning an average return of 6% would double every 12 years

5 Per USA Today in 2013, average salaries for NFL-$1.9M; MLB-$3.2M; NBA-$5.15M; NHL-$2.4M

6 Bureau of Labor and Statistics